On this week’s blog, our guest Lucy Manole will share how to finally save up for that beach vacation you deserve. Enjoy! ;-)

To most people, saving money is one of the most tedious activities that they know they should be doing but put it off anyway. If you’re reading this, you know you’re guilty of it.

Truth be told, yes – saving money is just one of those necessary evils – but it doesn’t have to be a dull chore. All it needs is a bit of spicing up to become a more interesting and doable task. Try these five offbeat ways to start saving up for that much-needed beach holiday:

1. Pay up for bad habits

Let’s start off with the money jar classic – penalizing yourself for your bad habits. It is super straightforward to put into practice and highly effective.

Pick a bad habit of yours that you want to do away with. Grab an empty jar and label it with that bad habit. Then, decide a generous amount of money (say, $5) to put in the jar each time you engage in the said bad habit.

Let’s take swearing, for instance. If you want to put an end to your nasty habit of cursing all the time for no reason, this can be the answer. Deposit that hefty fine of $5 in the “swear jar” every time you use bad language like an oaf.

If you think about it, not saving money itself is a bad habit as well. Talk about killing two birds with one stone.

2. Make things expensive for yourself

Wait, it’s not what it sounds like. This is an ingenious technique to save money while keeping a check on impulsive shopping and reckless spending. We’ve all been there, casually window shopping on Amazon and before you know it, a product is “out for delivery”.

So, here’s the deal – the next time you decide to make a self-gratifying purchase, such as buying that cute clutch you’ve had your eye on for a while – make it mandatory to pay a generous amount to your savings too.

This way, every self-gratifying purchase would become more expensive than it actually is (psychologically, of course) which will force you to rethink your shopping and curb unnecessary spending.

3. Challenge yourself

Are you a competitive person who enjoys a good challenge? Great – leverage this personality trait to save yourself some big bucks.

Here are three money-saving challenges for you to try:

Cash only challenge:

There are several studies that suggest you spend less money when you use cash instead of cards. For this challenge, you can leave your automated bills as they are, but for groceries, eating out, recreation, and shopping, use cash alone. Do this for a month or two and see if you are encouraged to save that cash instead of shelling out.

Save your change challenge:

Once you start using more cash, you can start accumulating all of your loose change to see how much you can save in a month or even a year.

You can even compete with your friends or family members to see who can save the most change in the predefined duration.

No spend challenge:

A no-spend challenge is where you resolve to only spend money on necessities for a defined period of time. So, you can have no spend days, weeks or months when you are challenging your self-control. Some people choose to use a calendar and put a big X on the days where they don’t squander any money on non-essentials. The purpose is to bring to light the amount of extra cash you can save if you control spending on little things.

4. No coupon, no purchase

Another unsophisticated way to fill up your dream holiday piggy bank is to swear by a strict policy of not making everyday purchases without using coupons.

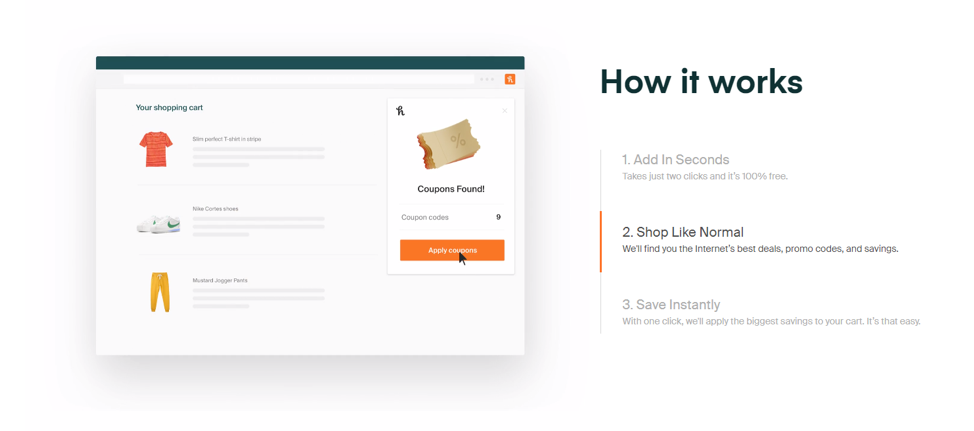

These days, there are coupons and discount codes for everything. All it takes is a little effort to find them. But even that labor is minimized as there are so many online tools available today that hunt coupons for you.

The Honey app is one of the most popular and reliable ones. Simply add their free browser extension and it will automatically scour the web for coupons when you’re checking out at any website. It’s a very easy and effective means to save money on your everyday purchases.

5. Use an app to reward yourself

Finally, how about some positive reinforcement to make things more interesting? There are quite a few apps and tools that use gamification to make saving money fun and rewarding.

For example, SmartyPig offers a special cash boost when you reach your savings goal using their online piggy bank – either a cash reward or store gift card – equal to a percentage of the savings goal you meet.

So, how do you plan to save up for that beach holiday you’ve been daydreaming of? Do share your thoughts in the comments below!

Special Offer From Mind Movies: Now speaking of wealth and saving money, before you go, I have a special surprise for you! It’s my pack of 3 FREE Mind Movies that will instantly start retuning your relationship with money - turning you into a walking, talking, money magnet! Valued at $117, I promise this is the most rewarding thing you will do today. Get them for FREE here while they are still available!